In 2009, Environmental Liability Transfer, Inc. (ELT) played a critical role in the Chapter 11 bankruptcy reorganization of ASARCO (American Smelting and Refining Company, LLC), and the subsequent redevelopment of environmentally-contaminated sites in Perth Amboy, NJ and Houston, TX.

Overview

In 2009, Environmental Liability Transfer, Inc. (ELT) played a critical role in the Chapter 11 bankruptcy reorganization of ASARCO (American Smelting and Refining Company, LLC), and the subsequent redevelopment of environmentally-contaminated sites in Perth Amboy, NJ and Houston, TX.

ASARCO was a leading producer of copper and one of the largest nonferrous metal producers in the world. Based in Arizona, the company was responsible for manufacturing sites around the country, some of which experienced contamination due to hazardous waste as a byproduct of operations, a common occurrence within the metals manufacturing industry. Due to the high level of environmental stress that took place at ASARCO’s metal manufacturing sites, when the Company declared bankruptcy in 2009, it was the largest environmental bankruptcy in U.S. history, at that time.

ASARCO was a leading producer of copper and one of the largest nonferrous metal producers in the world. Based in Arizona, the company was responsible for manufacturing sites around the country, some of which experienced contamination due to hazardous waste as a byproduct of operations, a common occurrence within the metals manufacturing industry. Due to the high level of environmental stress that took place at ASARCO’s metal manufacturing sites, when the Company declared bankruptcy in 2009, it was the largest environmental bankruptcy in U.S. history, at that time.

Bankruptcy Stalls

A federal judge ordered $1.79 billion USD to be paid into a multi-state remedial trust funded by the assets of the bankrupted ASARCO. The funds would be used collectively by 19 states to pay for past and future costs incurred by federal and state agencies at more than 80 sites impacted by ASARO’s past operations.

Two states were not pleased with the proposed solution. Texas and New Jersey both realized the danger of a multi-state trust and feared a depletion and/or unfair allocation of remedial funds. Neither would comply with a solution that would put remediation and redevelopment in their states at risk. A solution was needed for the bankruptcy to progress.

Solution: Environmental Liability Transfer

Environmental Liability Transfer, Inc. (ELT) was brought in to become a surrogate responsible party. ELT signed regulatory consent orders and agreed to operate with funds exclusively dedicated to each state. ELT became the new legally responsible party and assumed environmental obligations to remediate the sites to each state’s’ regulatory standards. Additionally, ELT agreed to be responsible to continue cleanup, should the remedial funds be insufficient.

As a condition of the agreement, ELT agreed to purchase the real estate and permanently indemnified ASARCO against specified legacy environmental liabilities associated with the sites – including known and unknown, above grade, at grade, below grade, whether the issues occurred in the past, present, or future.

As a condition of the assumption of environmental liabilities, ELT entered into and signed a consent order with the New Jersey Department of Environmental Protection (NJDEP) and the Texas Commission of Environmental Quality (TCEQ), which positioned ELT as the new Responsible Party at each site. NJDEP and TCEQ were then able to grant Settlement Agreements to ASARCO permanently releasing them from legacy environmental liabilities at the sites.

Finally, the proceeds from the sale of the real estate and the immediate release from the ongoing costs associated with environmental liabilities inured to the benefit of ASARCO’s Creditors Committee.

Results: Sustainable Redevelopment

With ASARCO, the regulators (NJDEP & TCEQ), and the Creditors Committee now satisfied, the Bankruptcy Judge approved the agreement and the bankruptcy progressed to completion.

As a condition of the transaction in New Jersey, ELT was required to obtain a cost cap policy with limits up to $12,800,000 USD. ELT was also required by NJDEP to meet a Financial Assurance obligation of $8 million USD.

Since acquiring the sites in 2009, ELT has been working with affiliate company EnviroAnalytics Group LLC (EAG) to bring the sites to state regulatory standards and prepare the sites for vertical development.

The Texas site required groundwater and soil required decontamination of radiological matter – all remedial objectives have been met and the site in now undergoing environmental monitoring activities. Today, the site is occupied by a large import/ export storage company.

At the New Jersey site, pre-development environmental remediation activities are ongoing and include: soil treatment and excavation, asbestos abatement, demolition of existing structures, construction of a groundwater treatment system, and other remedial measures.

In March 2015, during a ceremony to kick-off the demolition stage of the New Jersey site, Perth Amboy Mayor Wilda Diaz said the following about ELT’s private financing of the project:

For several decades, outer State Street (site) has been plagued with hundreds of acres of environmentally challenged sites, but today is a new day in Perth Amboy. The creation of local job opportunities and the realization of new ratables are the primary goals of establishing a sustainable project that will carry Perth Amboy into a successful future.

Commercial Development Company, Inc. (CDC), another ELT affiliate, has developed plans to reposition and redevelop the Texas and New Jersey sites to maximize their waterfront and logistical attributes. Vertical redevelopment plans for the sites are underway and include the construction of multiple industrial and mixed-use buildings. CDC is scheduled to break ground in 2017.

This case study is part of the article: “An In-Depth Look Into the Role of Environmental Liability Transfers During Bankruptcies”) and has been reproduced with permission from the Environmental Due Diligence Guide Report, Supp. 283, Pg. 231:2721 (September 17, 2015). Copyright 2015 The Bloomberg Bureau of National Affairs, Inc. (800-372-1033) www.bna.com.

Shed Environmental Liabilities and Non-Core Assets During Bankruptcy

Chapter 11 bankruptcy does not provide a blanket release from environmental obligations. A debtor owning environmental liabilities is exposed to higher financial risk during bankruptcy due to increased pressure from creditors and regulators seeking resolution of non-dischargable environmental obligations.

Unless resolved, as a debtor emerges from Chapter 11, environmental obligations can remain on the company’s balance sheet.

ELT’s robust corporate indemnifications can assume all environmental obligations (past, present, future, above/below grade, on-site/off-site) and guarantee site remediation to regulatory standards, secured with an environmental trust.

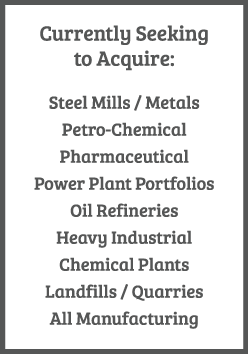

ELT is currently seeking to acquire environmental liabilities and non-core assets in the following sectors:

Contact ELT