Environmental Liability Transfer, Inc. (ELT) has been trusted to assume over $1.5 billion USD in corporate environmental liabilities throughout North America.

KEY PROJECTS

Brayton Point Power Station (Dynegy)

Somerset, MA

In 2018, ELT assumed environmental liabilities at the retired Brayton Point Power Station – a retired 1600 MW coal-fired power plant on the south coast of Massachusetts. CDC purchased real estate and power plant assets. CDC then invested significant resources to transform the waterfront property and prepare it for post-coal utilization. Pre-development activity will include asbestos abatement, environmental remediation, and demolition of coal-related infrastructure on the site. Since acquisition, CDC has made tremendous strides developing an offshore wind manufacturing hub at Brayton Point. Once the largest fossil-fueled power plant in New England, the property will now be home to a subsea cable manufacturing facility (Prysmian Group) and an electric converter station (SouthCoast Wind) which will connect offshore wind farms to the regional grid. Learn more at www.BraytonPointCommerceCenter.com.

This project was named 2023 Redevelopment of the Year by CoStar Group for the Boston market. Read about the award-winning project here: https://www.costar.com/article/169129565/shuttered-coal-fired-power-plant-gets-new-life-as-renewable-energy-hub

Evraz Steel Mill

Claymont, DE

In 2015, ELT assumed environmental liabilities and initiated environmental remediation efforts at a 425-acre, environmentally-distressed former Evraz steel mill in Claymont, DE. At the same time, ELT affiliate CDC commenced a multi-faceted construction project expected to include 3.75 million square feet of space called “First State Crossing”. The estimated $850 million new construction project is expected to have the largest economic development impact of any project in the state, and include office, residential, retail, light-industrial, a new $70 million public transit center, a public park, and other community amenities.

This project was named 2023 Commercial Development of the Year by CoStar Group for the Philadelphia market. Read about the award-winning project here: https://www.costar.com/article/286472838/reimagining-of-former-steel-mill-is-expected-to-drive-regions-economy

Tanners Creek Power Plant (AEP)

Lawrenceburg, IN

In 2016, CDC purchased the 725-acre, 1,000-MW retired AEP coal-fired power plant in Lawrenceburg, IN. ELT agreed to assume legacy environmental liabilities and decommissioning obligations at the site. Since the acquisition, CDC has invested significant resources to prepare the site for redevelopment, including asbestos abatement, site wide demolition, ash pond closure, removal of residual coal, and ongoing environmental monitoring. Immediately following the ownership transfer of Tanners Creek, many parties identified the site as a favorable location for the development of a major inland port.

“While I&M’s expertise in generating power is no longer needed at this site, ELT will use their talents to prepare the site for potential future use and continued benefit to the community.” – Paul Chodak III, President and COO of I&M

Janesville Assembly Plant (General Motors)

Janesville, WI

In December 2017, CDC agreed to purchase the historic Janesville Assembly Plant from General Motors. As part of the transaction, ELT assumed the environmental liabilities associated with the site and its former operators. With 4.8 million sq/ft of buildings under roof, the “Janesville Assembly Plant” was once the largest General Motors automotive plant in the world. CDC will now invest significant resources to reposition the 250-acre industrial property for new utilization. Activity includes asbestos abatement, demolition, environmental remediation, and extensive redevelopment planning. Today the 250-acre site is ready for the next phase of progress – redevelopment. CDC believes the former Janesville Assembly Plant could attract manufacturing, warehousing, and logistics-related development due to existing site features such as rail access and 250 acres of development-ready land.

RG / Bethlehem Steel Mill

Sparrows Point, MD

Poor market conditions resulted in an RG Steel bankruptcy and the largest brownfield development project in North America In 2014, an affiliate company purchased 14 MSF of buildings on 3,100 Acres at Sparrows Point. The company assumed the environmental liabilities, signed consent orders with the EPA and MDE, and subsequently sold the real estate, yet retained the environmental liabilities. Environmental issues include Soil & groundwater impacts from 100+ years of steel manufacturing. Our environmental remediation work at Sparrows Point will prepare this distressed property for the development of “Tradepoint Atlantic” – an international trade hub expected to create $2.9 billion in regional economic activity. Construction currently underway.

“The potential for redevelopment could yield as many as 10,000 jobs within 10 to 15 years.” – Baltimore Sun

Shell Global Portfolio

135 Sites Throughout Canada

ELT is currently managing remedial activities at 150+ sites formerly owned and operated by Shell Global. Located across ten Canadian provinces/territories and 3 U.S. states, these sites were impacted by petro-hydrocarbons due to past oil services operations. Shell determined that managing environmental contamination was outside their core business and decided to transfer environmental liabilities to ELT. This transaction subsequently jumpstarted the environmental clean-up process. Today, 40% of the impacted sites have been brought to regulatory closure. The remaining sites are on track to achieve regulatory closure prior to predetermined timeline goals.

ELT is currently managing remedial activities at 150+ sites formerly owned and operated by Shell Global. Located across ten Canadian provinces/territories and 3 U.S. states, these sites were impacted by petro-hydrocarbons due to past oil services operations. Shell determined that managing environmental contamination was outside their core business and decided to transfer environmental liabilities to ELT. This transaction subsequently jumpstarted the environmental clean-up process. Today, 40% of the impacted sites have been brought to regulatory closure. The remaining sites are on track to achieve regulatory closure prior to predetermined timeline goals.

This transaction enabled Shell to divest non-core, contaminated real estate, transfer significant environmental liabilities to ELT, secure environmental clean-up with fully-funded remedial trusts, and reallocate capital and manpower to core operations.

Emerald Performance Materials

Henry, IL

In September 2021, ELT announced the acquisition of Midwest chemical plant which was required to facilitate a greater transaction between two multi-national corporations. ELT’s involvement cleared the way for completion of the deal, with an enterprise value of $1.1 billion. An ELT affiliate will now operate essential systems at the plant necessary for continued output at the 34-acre facility. Originally constructed in 1958, the plant has multiple functions including the manufacture of rubber accelerators and antioxidants. In addition to continuing operations at the chemical plant, ELT affiliates will perform selected demolition and liquidate surplus machinery & equipment. “ELT is pleased to have played a critical role in this transaction by using our talents and capital to not only provide fair market value for the chemical plant, but also provide confidence to all parties involved that plant operations will continue uninterrupted,” said Randall Jostes CEO of Environmental Liability Transfer.

Coos Bay Lumber Mill (Georgia Pacific)

Coos Bay, OR

In 2020, ELT announced the purchase a 162-acre retired lumber mill property in Coos Bay, Oregon. ELT oversaw demolition of buildings and liquidation of equipment, with an eye to redevelop shortly thereafter. ELT affiliate CDC explored development options with several parties and met with local economic leaders to identify the best prospects to use the waterfront land and port. The property includes two private rail spurs, access to major shipping channels, heavy power, a 1,200-ft dock with access to Pacific Ocean shipping channels, and is located near highways and airports. Additionally, the former lumber mill property is also located in a Foreign Trade Zone and Enterprise Zone. The property has since been sold and is being developed by the Port of Coos Bay.

Solutia Chemical Manufacturing Plant

Trenton, MI

ELT acquired a 149-acre retired chemical plant from a Solutia affiliate in 2022, by affiliate. The transaction included the acquisition of real estate, as well as machinery & equipment. Located in Trenton, Michigan, the retired plant operated for 79 years and was used to manufacture polyvinyl butyral (PVB) resins and other specialty chemical products. CDC will now oversee demolition of buildings and liquidation of equipment, with an eye to redevelop shortly thereafter. The site has development attributes that will attract industrial users once the property is repositioned – 20 minutes from DTW airport, along the Detroit River, and two onsite rail spurs connecting operations to major North American freight railroad networks.

Newberg Paper Mill (WestRock)

Newberg, OR

Following more than 90 years of operations, the 220-acre industrial campus was used to produce paper for newspapers, brown paper bags, and corrugated carboard. The Newberg plant officially closed in January 2016. In 2020, CDC & ELT announced acquisition of a retired paper manufacturing plant in Newberg, Oregon. The transaction included the acquisition of real estate assets and a corporate indemnification for legacy environmental liabilities associated with the site facilitated by ELT. CDC will reposition the site to take advantage of the site’s development potential, which includes 120 acres of industrial/mixed land, four acres of multi-family land, and 1.5 acres of commercial land located in an Opportunity Zone and Enterprise Zone. Additionally, the site has heavy power, easy proximity to the I-5 transportation corridor, and potential for both rail access and significant water rights.

Uncasville Paper Mill (WestRock)

Uncasville, CT

In 2020, ELT affiliate acquired a retired 57-acre retired paper manufacturing plant from located in Uncasville, Connecticut. Since the transaction, ELT and affiliates have taken steps to redevelop the property, which include demolition, environmental remediation, and other site closure obligations. The site has expansive river frontage along the Thames River, deep water docking access with an existing 400-ft concrete pier, and multiple rail spurs on site. Additionally, the site has excellent transportation access and multiple open areas which can be used for lay down areas for the crane and construction industries.

Picway Power Plant (AEP)

Columbus, OH

In 2016, ELT agreed to assume legacy environmental liabilities at a 468-acre retired AEP coal-fired power plant outside Columbus, OH. Decades of coal plant operations prohibited a traditional real estate transaction. An environmental liability transfer and remediation plan proposed by ELT has jumpstarted environmental cleanup and enabled the site to be repurposed for new industrial utilization. ELT assumed unique & complex regulatory obligations and redevelopment impediments: Removal of river baffle, ash pond closure, reroute of transmission lines, buried rail line, and others. ELT assumed unique & complex regulatory obligations and redevelopment impediments: Removal of river baffle, ash pond closure, reroute of transmission lines, buried rail line, and others.

Shuttered Metals Manufacturing Facility (ASARCO)

Perth Amboy, NJ

In 2009, ELT played a critical role in the Chapter 11 bankruptcy reorganization of ASARCO (American Smelting and Refining Company, LLC), and the subsequent redevelopment of multiple environmentally-contaminated sites in the US. One of those sites was a 70-acre aluminum smelter in Perth Amboy, NJ. ELT acquired the real estate, assumed environmental liabilities, and initiated an environmental cleanup plan that has created a platform for new development. The site has since been sold to a warehouse developer who just announced a 1 MSF high-capacity storage and distribution center to be built on the property.

511-MW Coal Fired Power Plant (DTE Energy)

Marysville, MI

After 80 years of operations, the “Mighty Marysville” closed in 2011 and quickly became a local hazard/eyesore. DTE Energy sought a buyer that would provide fair market value for real estate assets, remove the liability from its balance sheet, and reposition the site for its highest and best use. ELT purchased the power plant and indemnified DTE Energy from future environmental concerns and regulatory obligations. Environmental remediation and demolition are now complete and the property has been sold to an industrial developer.

Industrial Reclamation (Former Des Peres Quarry)

St. Louis, MO

Commercial Development Company (CDC) purchased this 180 foot deep rock quarry in 1995, with the intention to reclaim the environmental hazard for new use. CDC hauled in approximately 6,250,000 cubic yards of inert fill material to transform this site into one of the most attractive infill development tracts available in St. Louis County. Today, the 26-acre site is a new economic hot spot in St. Louis County – a mixed-use development featuring assisted living facility, luxury apartments, hotel, Commercial Development Company’s HQ building.

Canadian Petroleum Portfolio

Throughout Canada

In 2016, ELT agreed to assume legacy environmental liabilities in a 17-site portfolio of retired oil-related sites from a major Canadian oil company. ELT secured remediation with a fully-funded remedial trust, and provided indemnification to the Seller. Real estate assets were also purchased at a price exceeding $10 million USD. Today the sites have been brought to regulatory closure points and sold/occupied by non-petroleum industrial users.

Former Paper Processing Plant

Antioch, CA

ELT assumed environmental liabilities at a 108-acre waterfront industrial site formerly operated as a paper mill. For several decades, this property was a paper mill operated by Gaylord Container Corporation until it was retired and demolished in 2002. Since closing, environmental impact from past operations has limited redevelopment options. ELT’s remediation plans give fresh potential to redevelop this attractive waterfront industrial site. Today, environmental conditions at the site have been resolved and the site is leased to a global port logistics and transportation company.

Deepwater Port (Atlantic Wood Industries)

Savannah, GA

ELT indemnified Atlantic Wood Industries from future expenditures concerning legacy environmental liabilities and purchased the real estate at a 58-acre waterfront industrial site located adjacent to the Port of Savannah. Site-wide remediation is now complete under a RCRA permit and Commercial Development Company (CDC) has leased the property to 2 industrial users. Environmental Concerns: Wood-treating wastes and residues; petroleum hydrocarbons; RCRA closure obligations caused by heavy metals

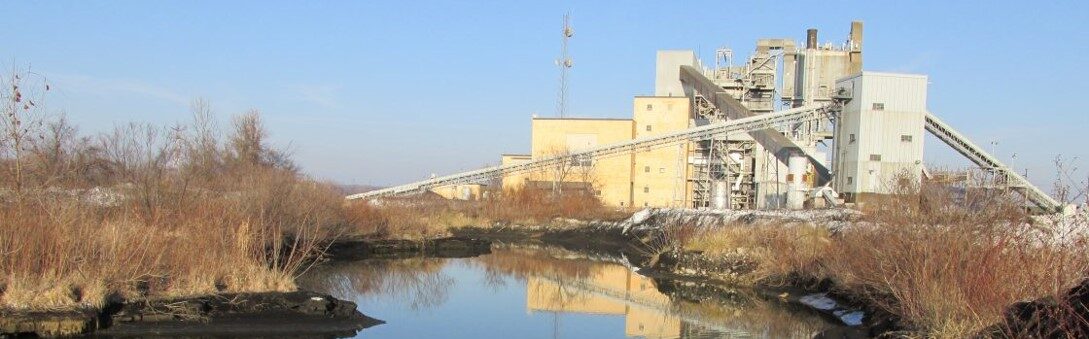

55-MW Coal-Fired Power Plant (AECI)

Chamois, MO

ELT assumed the environmental liabilities at this retired coal-fired power plant in Chamois, MO. CDC purchased the real estate. Environmental remediation, demolition, and other decommissioning activities will now commence. The expected timeline for completion is 3 years, at which point the site will be marketed for potential reutilization. “Associated sought proposals from more than 50 firms for decommissioning the facility and employed a third-party engineering firm to review those proposals. Associated chose to partner with CDC & ELT due to their reputation and varied resources to fully decommission the plant and remediate the site.” — Brian Prestwood, VP & Chief Compliance Officer at Associated Electric Cooperative, Inc. (AECI).

Akzo Nobel – Reading, PA

In 2016, ELT assumed the environmental liabilities at this 20-acre former paint manufacturing plant in Reading, PA. CDC purchased the real estate. This transaction has jumpstarted the environmental cleanup process which gives new potential to redevelop and reutilize this industrial site.

Congoleum Factory – Hamilton, NJ

In 2015, ELT assumed the environmental liabilities at this 65-acre former flooring manufacturing plant in Hamilton, NJ. CDC purchased the real estate and is repurposing this former industrial site into a new mixed use asset. Demolition is now complete, and mixed-use redevelopment planning is well underway.

Caterpillar Corporation – York, PA

As part of the purchase of this 2.7 million square-foot facility, CDC assumed environmental liabilities, and leased back the real estate. Working with Caterpillar, ELT effectively abated all relevant environmental issues and brought the site to closure through the state of Pennsylvania’s Act II program. ELT began the necessary work to transform this heavy industrial facility into a modern, multi-use property – making it appealing to both manufacturing and warehouse/distribution users and ultimately sold portions of the site to an end user. Environmental Concerns: Asbestos, RCRA metals, petroleum impacted groundwater and soil, PCBs

Chrysler Corporation – Huntsville, AL

ELT purchased this 250,000 square foot high-tech manufacturing facility located on 36 acres within the prestigious Cummings Research Park in Huntsville, AL. The site was used in the construction of instrument panels for Chrysler vehicles. The transaction included a complete environmental liability transfer and required approvals from the United States Treasury and Federal Bankruptcy Courts. Environmental Concerns: Chlorinated volatile organics in soil and groundwater

ASARCO – Houston, TX

Acquired out of bankruptcy, this 22-acre former metals-related manufacturing plant was on the Texas State Superfund List. The site contained groundwater and soil contamination impacted by volatile organics, heavy metals and radiological materials. ELT entered into a Consent Order with TCEQ (Texas Commission on Environmental Quality) and was required to post financial assurance in the amount of $29,000,000. Environmental Concerns: Radiological, volatile organics and heavy metal contaminants in the groundwater and soil

General Motors: West Mifflin, PA

This 1,000,000 square foot former stamping plant located on 72 acres in West Mifflin, Pennsylvania, was purchased from Motors Liquidation Company, the bankruptcy estate of General Motors. After 60 years of heavy manufacturing, this facility had a host of environmental issues that were remediated under the ACT II program. Building abatement and demolition were also required to facilitate the redevelopment of the site. This transaction required approvals from the United States Treasury, Pennsylvania Department of Environmental Protection (PADEP) and Federal Bankruptcy Court. Environmental Concerns: PCBs, volatile organics and petroleum hydrocarbons.

General Motors – Euclid, OH

Acquired from General Motors, this Fisher Body facility consists of 64 acres of ground and 1.1 million square feet of building structure. A significant environmental liability transfer plan was introduced, resulting in a net positive cash transaction for General Motors.

General Motors – Sioux City, IA

Located on 27 acres, this 207,000 square foot facility was purchased from General Motors in concert with a transfer of environmental risk. Various environmental issues were abated and currently the facility is being leased to a national distribution company.

General Motors – Danville, IL

ELT purchased this 700,000 square foot General Motors foundry located upon 101 acres, complete with all production equipment, in concert with an environmental liability transfer. After abatement, the facility was sold to a local manufacturing concern which, in turn, received complete indemnification against environmental liability.

Kinder Morgan / El Paso Gas – Wichita, KS

ELT acquired this former 107-acre refinery located on Interstate 135 in Wichita, KS from Coastal Derby Refining Company (Kinder Morgan / El Paso Energy Petroleum Company). The refinery, which opened in 1920, closed in 2003 leaving the site inactive for nearly 10 years. The site was used to process and refine crude oil. ELT has conducted considerable investigation and soil and groundwater remediation under an agreement entered into with the Kansas Department of Health and Environment (KDHE) and has plans to return the site to productive use. Environmental Concerns: Petro-hydrocarbons

Chemtura Corporation – Harmony, NJ

ELT acquired Chemtura’s environmental liabilities and purchased the real estate from Harmony Township thus ending years of litigation between the parties. Approvals were required from NJDEP, Federal Bankruptcy Court, and the Creditors Committee of Chemtura Corporation. ELT funded a multi-million dollar remedial trust to serve as financial assurance and has completed remediation of PCB impacted soil and in-situ treatment of groundwater contamination. Environmental Concerns: Free-product on groundwater, VOC impacted groundwater; PCBs in soils, wetlands restoration

Gibson Group – Bakersfield, CA

ELT purchased this 6-acre former oil-waste disposal facility and its associated liabilities from the Gibson Group. The Gibson Group was a coalition of 58 PRPs (potentially responsible parties) that took ownership of the site after the operator abandoned it, leaving the Gibson Group with the clean-up obligations. A Certificate of Completion has been received from California’s DTSC, certifying required environmental remedial work associated with the site has been completed. The site was subsequently sold and has been brought back to productive reuses.

FRU-CON Construction Corporation – St. Louis, MO

ELT acquired this 42-acre riverfront site and its associated environmental liabilities from FRU-CON Construction Corporation, the 10th oldest contractor in the United States. The site had originally been used for the storage of cement kiln dust and had been impacted by the storage of asbestos products manufactured by the adjacent cement plant. The transaction enabled FRU-CON to divest of an estimated $3.8 million in environmental liabilities. Environmental Concerns: Cement kiln dust, asbestos and low pH soils

ABB / Westinghouse – Muncie, IN

Purchased from ABB, this 750,000 square foot facility manufactured large capacity transformers for both Westinghouse and ABB. The environmental liability transfer included an onsite landfill, PCBs in the soil and groundwater, as well as free-floating petroleum on the groundwater. After remediation under State and Federal oversight, the site was sold to a warehouse and distribution company. Environmental Concerns: PCBs in the soil and groundwater, free-phase petroleum impact

Kaiser Aluminum – Mead, WA

ELT purchased this 1.8 million square foot aluminum smelter out of bankruptcy. Located on 450 acres, a portion of the property includes a Superfund Site. The Kaiser Bankruptcy Trust received payment for the facility, its equipment and land, and a transfer of all environmental liabilities. ELT completed remedial activities under an Order with the Department of Ecology which included the decommissioning of over 1,000 pots lined with more than 8,000 tons of hazardous waste and addressing a 1,500 foot long rectifier yard. Following remediation the site was sold for commercial development. Environmental Concerns: K088 wastes, fluorides, PCBs, semi-volatiles and asbestos.

Millennium Chemicals – 13 Site North American Portfolio

CDC acquired a combination of 13 sites throughout North America totaling over 1 million square feet under roof and approximately 130-acres of land. The properties included former plating operations, ore processing plants, paper mills, paint manufacturers and other heavy industrial sites. Remediation of all sites has been completed to end-points designated by the seller, a majority of which included obtaining state certified closure. Environmental Concerns: Asbestos, underground tank removal, and soil and groundwater impacted with heavy metals, volatile organics, PCBs, and petroleum products.

PMX Corporation – Euclid, OH

This surplus, corporate asset was purchased in 2003. The site consisted of a 629,000 square foot facility located on 78 acres and was formerly used for the production of copper wire. The liability transfer and assumption included an onsite landfill, heavy metals in the groundwater and soil, fugitive dust and asbestos containing building materials. The contaminants were abated and the facility was demolished prior to being sold for the development of a new industrial park. Environmental Concerns: Onsite landfill, groundwater and soil impacted by heavy metals, asbestos

Kraft General Foods – Evansville, IN

This site was purchased by CDC in 1994. As part of the site’s risk management remedial programs, 142,000 square feet of structure were razed. Substantial asbestos removal and PCB remediation were implemented as well as the removal of nine underground tanks and the remediation of associated contaminated soil. Environmental Concerns: Asbestos, PCBs, USTs

Uniroyal Corporation – Port Clinton, OH

Working with Uniroyal Corporation, the “Debtor in Possession”, this facility was purchased through the Bankruptcy Courts in 2002. Included in the acquisition was a complete transfer of environmental liabilities, covering issues both on and offsite. The property possessed landfills, unexploded ordnance, chlorinated impacted soil and groundwater, and multiple above ground storage tanks. Environmental Concerns: Landfills, chlorinated impacted soil and groundwater, storage tanks

Textron Corporation – Cheshire, CT

This 550,000 square foot surplus asset of Textron was purchased in 1995 and included a complete environmental liability transfer benefiting the seller. By extending the transfer of liability to a secondary purchaser, the site was immediately re-sold to a risk adverse major retailer. The site had PCB contaminated soils, asbestos contamination, required PCB transformer removal, and PCB impacted wood block floor removal. Environmental Concerns: PCBs, asbestos, significant below-grade contamination

RR Donnelley / Cardinal Brands – Topeka, KS

In 2007, RR Donnelly’s pending acquisition of Cardinal Brands stalled due to legacy environmental liabilities associated with a 120,000 square foot surplus facility located in Topeka, KS. ELT was brought in to purchase the site, assume the environmental liabilities and extend corporate indemnifications to both RR Donnelley and Cardinal Brands. In doing so, ELT paved the way for RR Donnelley and Cardinal Brands to complete their transaction. ELT is currently working with the Kansas Department of Health and Environment (KDHE) to bring the site to closure. Environmental Concerns: Chlorinated volatiles impact of soil and groundwater

BAE Systems – Minneapolis, MN

ELT purchased this 2,000,000 square foot office and industrial complex located on a 113-acre campus in Minneapolis, MN from BAE Systems. The transaction included transference and assumption of specified environmental liabilities as well as the lease back of 850,000 square feet to BAE Systems. In this transaction, BAE Systems was able to monetize surplus square footage, reduce overhead and carrying costs, and transfer environmental liabilities from their books. Environmental Concerns: Cyanide impact to soils, free-product on groundwater, on-site hazardous waste landfills

Heileman Brewery – Belleville, IL

This facility, located on 27 acres, was capable of producing 800,000 barrels of beer annually. The purchase included a robust liability transference and assumption program. As part of the remedial plan, 68% of the buildings were demolished while performing remediation that targeted asbestos, PCBs, below-grade petroleum hydrocarbons, and the removal of underground storage tanks. Fifteen acres were sold to an adjacent nursing home and approximately 180,000 square feet of structure was retained for future warehouse and distribution use. Environmental Concerns: Asbestos, PCBs, underground tank removal

Heileman Brewery – Frankenmuth, MI

This facility was acquired through the Federal Bankruptcy courts. Working closely with city planners, a remedial plan was implemented that included 75% demolition of the historic site. Asbestos containing building materials, PCBs in the soil and high pH conditions were abated.

Today the site is home to Bavarian themed shops and supports festivals that draw over 3,000,000 visitors per year. Environmental Concerns: Asbestos, PCBs, caustics

Heileman Brewery – Phoenix, AZ

This brewery, located on 24 acre, was purchased from G. Heileman Brewing Co. in 1993. The facility was capable of brewing 500,000 barrels of beer annually. Remediation included the removal of asbestos and PCB containing transformers. The brewing equipment was liquidated and the buildings demolished. The site was sold to the city of Phoenix and has become home to the Fire Department’s Headquarters Complex. Environmental Concerns: Asbestos, PCBs

Fruit of the Loom – Lafayette, LA

This 1,000,000 square foot facility located on 61 acres was purchased from Fruit of the Loom through the Federal Bankruptcy Courts. Working in concert with the trustees, an environmental liability transfer was implemented covering all known and unknown, and above grade and below grade issues. The final transaction brought positive value to the trustee and associated creditors and the property was subsequently sold for light industrial use. Environmental Concerns: Petroleum impacted soil and groundwater, asbestos, PCBs

Alpha Portland Cement – St. Louis, MO

This 680,000 square foot concrete and steel facility located on 145 acres was purchased in 1994 and included an environmental liability transfer. In order to implement the remedial strategy, all structures were demolished. Remedial issues included asbestos, PCB transformers and heavy metals. After completion of the remedial plan, the site was redeveloped into an industrial complex and now is home to several nationally recognized companies. Environmental Concerns: Asbestos, PCBs, heavy metals

Trelleborg / Reeves Brothers – NC & VA

ELT completed a 4 property environmental liability transference project in the south east United States. Reeves Brothers, a U.S. based chemical manufacturer was being acquired by Trelleborg of Sweden. Reticent to assume Reeves Brothers’ legacy environmental liabilities, Trelleborg engaged ELT to purchase the sites and to assume the associated environmental liabilities prior to closing on the acquisition of Reeves. The sites, all former industrial waste disposal locations, have all been remediated according to State mandated obligations and portions of the properties are being marketed for reuse. Environmental Concerns: CVOCs in soils and groundwater, pre-regulated landfills and disposal sites

Hanson America Quarry – San Antonio, TX

This idle, 170-acre quarry and former asphalt plant was acquired from Hanson America. This site was environmentally impacted by indiscriminate dumping of trash and industrial waste, including storage tanks up to 10,000 gallons in size, drums, asbestos containing machinery, brick manufacturing byproducts, tar bi-products, and other environmental hazards. Remediation has been completed and the site is being repositioned for redevelopment. Environmental Concerns: Asbestos, storage tank removal, tar plumes

ANH Refractories – Mexico and Farber, MO

In 2006, ELT purchased 650,000 square feet of manufacturing buildings on 1,200 acres from the bankruptcy estate of ANH Refractories. ANH effectively divested its shuttered facilities and shed environmental obligations estimated to be $4,000,000. ELT’s Principals were owners in a consortium that injected $40,000,000 into the revitalization of the former brick making facilities. In 2011, the facilities were reopened as Mid America Brick as a Face Brick production company. Environmental Concerns: Asbestos containing materials, petroleum hydrocarbons, solid waste disposal

Viacom / Westinghouse – Atlanta, GA

ELT acquired this 100,000 square foot facility on 17 acres in Atlanta, GA and all associated environmental liabilities from Viacom / Westinghouse. ELT removed the asbestos, demolished the buildings, and remediated soil and groundwater contamination in accordance with State and Federal requirements. To maximize the value of the site, ELT subsequently decided to clean the site to a more stringent environmental standards which allowed the site to be redeveloped into a premier golf and sports entertainment facility. Environmental Concerns: Asbestos, PCBs, VOCs in groundwater

SMM Holdings – Rockwood, TN

ELT purchased all stock of SMM Holdings Limited – a subsidiary of a South African company located in Rockwood, TN. ELT’s stock purchase allowed its South African client to effectuate a complete exit from the United States. As a new subsidiary of ELT, SMM Holdings was required to enter into an Order and post financial assurance with the State of Tennessee. The clean-up of the site – a former metals smelter – has been completed. The transaction required and received the approvals of the Tennessee Department of Environment and Conservation (TDEC). Environmental Concerns: Manganese, chrome slag disposal areas, metals and low pH in surface and groundwater

LaFarge Quarry – St. Charles, MO

CDC purchased this 120-acre quarry in St. Charles, MO from LaFarge Aggregates under a sale/leaseback agreement. When mining operations are completed CDC plans to reclaim the site with inert fill such as dirt, rock, asphalt, and concrete before developing the riverfront site.

CONTACT ELT

For confidential discussion regarding your property or to learn more about ELT, please contact us.